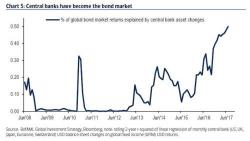

The Only Thing That Matters For Bond Traders, In One Chart

Inflation outlook, rate differentials, projected growth, positioning, quants... there are countless explanations provided daily to explain why bonds trade the way they do. And yet, as Bank of America shows today, as of this moment just over 50% of the global bond market returns can be explained with just one thing: central bank balance sheet changes.

BofA explains: