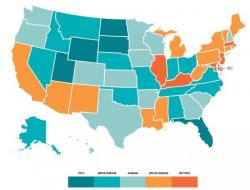

5 Charts That Explain Just How Screwed Your State Is

We've spent a lot of time of late discussing the precarious financial positions of states like Illinois, Connecticut and New Jersey which each suffer from their own myriad of financial threats including massive budget deficits, monstrous unfunded pension liabilities, pending debt downgrades, etc. In case you've missed those notes, here is a recap for your amusement: