Deutsche: "Once The Carnage From Higher Rates Hits, Then We Move To Helicopter Money"

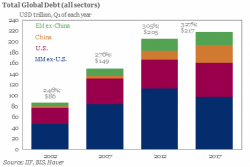

As Jim Reid writes, "it's been a very dull 24 hours" in the markets, so to pass the time the Deutsche strategist recapped his bigger picture thoughts "on government bond yields given the sell-off of the last two weeks." Hardly surprising, he goes along with the consesus, and expects yields to rise as more central banks turn hawkish (for reasons we have discussed on countless occasions, most recently yesterday) although what is interesting is Reid's take on what happens after the initial reaction, and it's here that the gloom descends because in a world with 327% debt/GDP...