Banks Are Saving Stocks As FANG Flops Again, DAX Hits 2-Month Lows

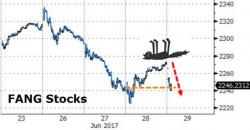

Yesterday's 'dead cat bounce' in FANG stocks has been erased as broad-based weakness stemming from increasing recognition of hawkish central bank chatter is hitting stocks and bonds. Bank stocks bounce after stress test 'success' are saving some indices from bigger losses.

FANG stock erased yesterday's gains...

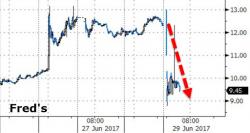

Bank stocks bounced overnight and remain green but are fading as the day progresses...

All major indices are in the red with The Dow holding up better as Nasdaq is hit hard...