Macro Manager Massarce: "Financial Markets No Longer Make Sense"

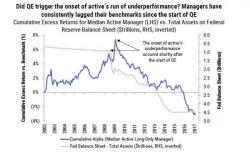

Over the past several years we have repeatedly stated that despite protests to the contrary, the single biggest factor explaining the underperformance of the active community in general, and hedge funds in particular, has been the ubiquitous influence of the Fed and other central banks over the capital markets, coupled with the prevasive presence of quantitative strategies, HFTs, algo trading and more recently, a surge in price-indescriminate purchases by passive, ETF managers.