The Inevitability Of DeGrowth

Authored by Charles Hugh Smith via PeakProsperity blog,

Even though we don't know precisely how the future will unfold, we know a few things about it:

Authored by Charles Hugh Smith via PeakProsperity blog,

Even though we don't know precisely how the future will unfold, we know a few things about it:

Authored by Mike Shedlock via MishTalk.com,

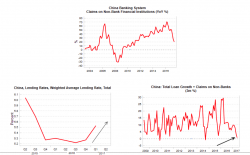

Variant Perception notes China Broad Credit Growth Slows to Zero. The side effect is a huge amount of collateral damage.

The recent tightening of credit we have seen in China is primarily aimed at clamping down on shadow financing. Wealth management products have rapidly grown in size, from only 8% of total banking deposits in 2012 to over 20% today.

US regulators aren’t yet comfortable with bitcoin ETFs (although a quad-levered S&P ETF is just fine for mom and pop), but apparently options and swaps are another story.

While it may come as a surprise to the current crop of 17-year-old hedge fund managers, the current period of persistently low long-term interest rates and plunging, near reocrd volatility in the face of a hawkish Fed and rising short-term rates, is hardly new: exactly the same happened from 2004 through 2006, despite the Fed's continued rate hikes and jawboning. Alan Greenspan, the Fed's Chair at the time, called this phenomenon a "conundrum" and blamed it on many things, including the global savings glut.

Submitted by Ronan Manly, BullionStar.com

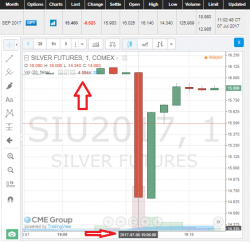

Silver futures prices on the COMEX futures trading platform briefly plummeted at approximately 7:06am Singapore time yesterday, with the price for the front month (most active) September silver contract falling from a US$16.06 quote down to a low of US$14.34 all within a 1 minute interval. The futures price then recovered nearly all of its losses in the subsequent 2-3 minute period. High to low, this COMEX silver futures contract saw its price fall by just over 10.7%, before rebounding nearly 11%.