"Maybe It Doesn't Matter What The Fed Does... Sure Didn't In 2008"

Authored by Jeffrey Snider via Alhambra Investment Partners,

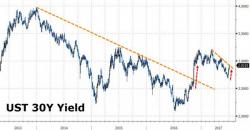

After the 2013 “reflation” selloff, it took just about two years for the treasury market to revisit (10s) the 2013 lows (rates).

In all that time, each and every bond selloff was met by the same assurances that “rates had nowhere to go but up” when instead the underlying fundamentals (economy as well as money/liquidity) were the same throughout.