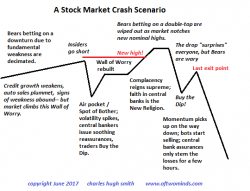

A Stock Market Crash Scenario

Authored by Charles Hugh Smith via OfTwoMinds blog,

The one thing we can know with certainty is it won't be easy to profit from the crash.

Authored by Charles Hugh Smith via OfTwoMinds blog,

The one thing we can know with certainty is it won't be easy to profit from the crash.

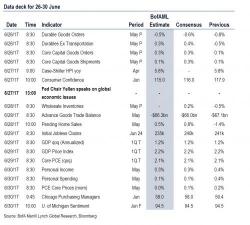

It's set to be a busy week with a a jam-packed agenda for central bank watchers, with speeches due from Janet Yellen, Mario Draghi, Mark Carney, Haruhiko Kuroda and more. Economic data may also drive momentum in financial markets, with closely watched reports due on inflation, employment, manufacturing and housing from China to the U.S. We also have GDP, durable goods and consumer confidence in US, industrial production in Japan and confidence indexes in EA

Key highlights:

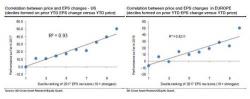

Following JPM's calculation that only 10% of trading is fundamentally driven by flesh-and-blood investors, and increasing rumblings that traders now exist at the mercy of machines, many of which respond merely to fund flows and not fundamentals, SocGen's Andrew Lapthorne cross-asset strategist will have you know that he will have none of that nonsense, and in a note that is sure to spark strong reactions across Wall Street, writes this morning that "with all the talk of systematic and passive investment dominating markets and, conversely, the apparently low participation of fundamentally-dr

One minute after 4am EDT, as the European market was warming up for trading, Gold suddenly plunged $12, or 1%, to $1,242 an ounce, on a surge in volume with 18k contracts, or just over $2 billion notional, trading in a one-minute window; as of 9:20am London, volumes running around 150% of recent averages. As so often happens, the gold plunge dragged silver down with it as well.

A better chart of the move comes courtesy of Nanex which shows how the sudden selling soaked up all the liquidity in the gold market in seconds, with the clear intention of repricing gold lower.