June Gloom: Nasdaq Suffers Biggest Loss Since October As Dollar, Bonds, Economy Plunge

The thundering herd of "individuals" shifted awkwardly as June came to an end...

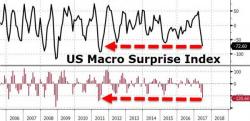

US Economic data in Q2 was the most disappointing since Q2 2011...

June was a rollercoaster: