In New Round Of "Brutal" Currency Wars, The ECB Is "Heading Down A Dark Alley"

From Bloomberg macro commentator Chris Anstey

Currency moves can be "brutal," as the European Central Bank well knows, since then-ECB President Jean-Claude Trichet used that memorable adjective more than a decade ago. The problem for the ECB is it may be heading down a dark alley where two well-armed peers await.

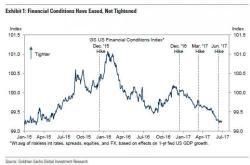

Investors have reasonable clarity about the medium-term policy outlook for the U.S. Federal Reserve and Bank of Japan, with both central banks effectively anchoring long-term rates.