Why Some Hedge Funds Believe The Shale Boom Coming To An End (Again)

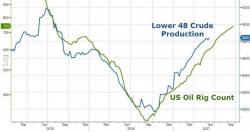

Today's Baker Hughes report confirmed that the US shale miracle continues, as another 6 oil rigs were added bringing the total to 747, the highest since mid-2015, with domestic producers seemingly oblivious - or perfectly well hedged - to the ongoing decline in crude prices which is once again set to crippled the Saudi budget.

And as has been the case for the past year, virtually all of the increase in rigs came from the Pemian basin...

... and if Goldman is right, this is just the beginning of a shale cypercycle that will triple shale production over the next decade.