Despite Bank Of Canada Hubris, Existing Home Sales Crash In May

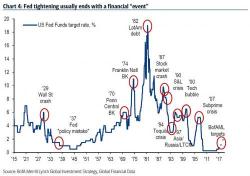

The Bank of Canada is stuck between the rock of a housing bubble (textbook-based trickle-down confidence-inspiration) and a hard place of a housing bubble (total lack of affordability) as it proclaimed this week that it may withdraw stimulus because, paraphrasing, everything was awesome. Well, today's existing home sales collapse may change that tune quickly...