When Will Janet Live Up To Her Reputation?

Authored by Kevin Muir via The Macro Tourist blog,

Authored by Kevin Muir via The Macro Tourist blog,

Courtesy of RanSquawk

Adding further pain to Q2 GDP hope, April Business Inventories tumbled 0.2% MoM in April (following Wholesale Inventories decline). This is the biggest drop since November 2015.

The November spike in inventories is now long gone...

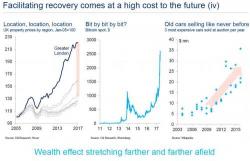

When global financial markets crash, it won't be just "Trump's fault" (and perhaps the quants and HFTs who switch from BTFD to STFR ) to keep the heat away from the Fed and central banks for blowing the biggest asset bubble in history: according to the head of the German central bank, Jens Weidmann, another "pre-crash" culprit emerged after he warned that digital currencies such as bitcoin would worsen the next financial crisis.

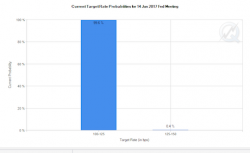

The Fed concludes its June meeting today. The Fed fund futures markets put the odds of the Fed hiking rates again at 99.6%.

This would mark the third rate hike by the Fed during this cycle.

Why would this matter?

Because it indicates the Fed is embarked on a serious tightening cycle. One rate hike can be a fluke. Two rate hikes could even be just policy error. But three rate hikes means the Fed is determined.