"Brutal Price Action" - Bonds & Bullion Surge, Dollar Dumps After Dismal Data Deluge

Disappointing inflation and retail sales data has sparked a surge in safe-haven demand for bonds and bullion, and left stocks confused this morning ahead of The Fed statement and press conference this afternoon...

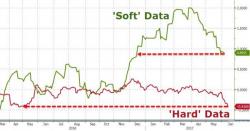

A disastrous morning for US macro data - and yet we are assured by The Fed that a hike is overdue and everything is awesome...

It's not!

Gold and Bonds are well bid...

Pushing 10Y yield to its lowest since Nov 10th...

And Nasdaq jumped on the dovish-inspiring data dump...