“This Market is Absolutely 100% Going To Crash”

By Chris at www.CapitalistExploits.at

Him: "This market is absolutely 100% gonna crash."

Me: "You sound so certain?"

Him: "Just look at the valuations."

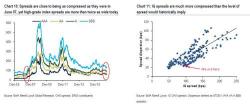

Me: "Pricey valuations don't always culminate in a market crash. There are other factors to consider."