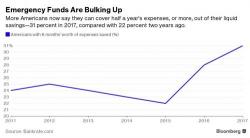

Millennials' Savings Rate Climbs For First Time In A Decade

America’s beleaguered millennials received a rare gift on Tuesday: A scrap of good news. Even with the aggregate student debt burden eclipsing the $1 trillion mark, and wages pressures across the US economy remaining relatively subdued, a new survey from Bankrate.com claims that Americans’ savings habits are improving for the first time in a decade, with the strongest gains recorded among the 18-26 demographic.