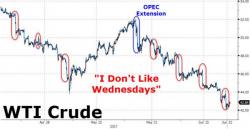

Is There Still Hope For Higher Oil Prices?

Authored by Nick Cunningham via OilPrice.com,

Oil prices have cratered in recent weeks, dipping to their lowest levels in more than seven months and any sense of optimism has almost entirely disappeared. All signs point to a period of “lower for longer” for oil prices, a refrain that is all too familiar to those in the industry.

WTI dipped below $44 per barrel on Tuesday, and the bearish indicators are starting to pile up.