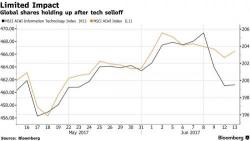

One Trader's Advice To Bond Bears: "Come Up With Something New"

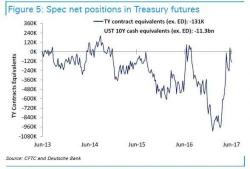

While stocks appear to have regained their footing this morning, not to mention upward momentum, the big quandary in markets remain not stocks but bonds, which refuse to validate a stronger growth narrative just one day before the Fed is set to hike rates for the second time this year. In fact, despite a recent record short squeeze in rates, with net specs recently turning bullish on the TSY complex...

... bond bears just can't seem to catch a break as yields continue to drift ever lower while the yield curve pancakes.