Falling Interest Rates Have Postponed "Peak Oil"

Authored by Gail Tverberg via Our Finite World blog,

Authored by Gail Tverberg via Our Finite World blog,

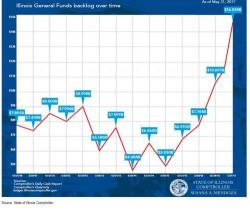

On June 1, first S&P the Moody's almost concurrently downgraded Illinois to the lowest non-Junk rating, BB+/Baa3 respectively, with both rating agencies warning that the ongoing legislative gridlock and budget crisis need to be resolved, or else Illinois will be the first ever US state downgraded to junk status.

Vladimir Putin: The Most Powerful Person In The World

Paul Craig Roberts

Authored by Alex Deluce via NIRP Umbrella blog,

After three decades of extensive money printing, debt accumulation and devastating financial bubbles millennials are experiencing what it feels like to never leave the parents’ nest egg. With The Fed's prolonged zero interest rate policy boosting housing prices back to near 2007 levels, young people simply can’t afford to buy a home.

Since The Fed began its 'tightening cycle' in December 2015, the Treasury yield curve (2s10s) has flattened dramatically, tumbling back today towards cycle lows (and well below Trump-election-hope lows). What is perhaps more worrisome is the historical trend strongly suggests this trend is far from over and an inverted yield curve looms.

The trend is clear that Fed policy is running counter to growth expectations and all the hope that Trump offered has been erased completely.