3 Charts That Show How "Enormously Overvalued" The Average Stock Is

Authored by Vitaliy N. Katsenelson via MauldinEconomics.com,

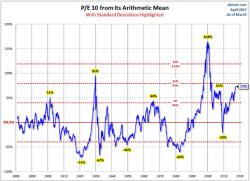

We are having a hard time finding high-quality companies at attractive valuations.

Authored by Vitaliy N. Katsenelson via MauldinEconomics.com,

We are having a hard time finding high-quality companies at attractive valuations.

Dude!! What's wrong with you brah?

While everyone wants to talk about what a great opportunity today was to BTFD in FANG stocks, we wanted to note one quick thing - US Macro data has crashed to 16 month lows...

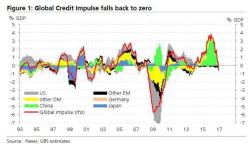

At the end of February we first highlighted something extremely troubling for the global "recovery" narrative: according to UBS the global credit impulse - the second derivative of credit growth and arguably the biggest driver behind economic growth and world GDP - had abruptly stalled, as a result of a sudden and unexpected collapse in said impulse.

Authored by Adam Taggart via PeakProsperity.com,

Steen Jakobsen back on, Chief Investment Officer of Saxo Bank, returns to the podcast this week to share with us the warning signs of slowing economic growth he's seeing in major markets all over the world.

In his view, the world economy is sputtering badly. So badly, that he's confident predicting a global recession by 2018 -- or sooner:

Authored by Kevin Muir via The Macro Tourist blog,

Think back to earlier this year. At the time, the market was convinced Trump was about to usher in a new wave of free market nirvana. Hedge fund managers piled into small cap equity long positions, confident the pro-growth policies would fuel a massive outperformance for the Russell 2000 index. Here is a chart I ran in my piece “The reality is something in between” which shows the extent of the small cap run: