Investors Go All-In On Europe

Investors added $871 million to the Vanguard FTSE Europe exchange-traded fund in the five days through Friday, pushing the largest European ETF to its largest two-week inflow in history.

Investors added $871 million to the Vanguard FTSE Europe exchange-traded fund in the five days through Friday, pushing the largest European ETF to its largest two-week inflow in history.

The US hedge fund industry is in rough shape as the Federal Reserve’s lift-all-boats monetary policy has made it increasingly difficult to beat the market. US hedge funds endured nearly $100 billion in redemptions last year, as only 30% of US equity funds beat their benchmarks.

Back in 2007, the ratings agencies were so woefully behind the eight ball in understanding and reporting the credit risks in the U.S. financial system that it was nearly impossible to tell from day to day whether they were really just that incompetent or if they were complicit in the biggest financial fraud in history. Regardless of which you believe is more likely, they seem intent upon not making the same mistake again...at least not in Australia.

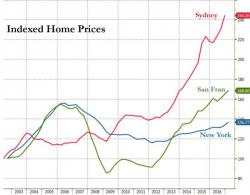

With the New York City real-estate market sagging under the weight of too much inventory following a credit-driven surge in multifamily housing in recent years, the return of Manhattan’s marginal buyer could finally be at hand.

A ranking of the city’s best-selling condo buildings from Property Shark hints at how the ultra-high end of the market, where units can sell for $20 million or more, appears increasingly vulnerable. While some of the top-selling buildings have racked up impressive sales totals, some have vacancy rates as high as 40%.

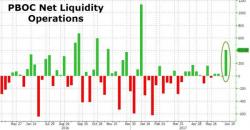

The good news - thanks to the largest liquidity injection in almost six months, yields on China's sovereign bonds have fallen - the biggest drop since Dec. 29, to 3.50 percent, while the one-year dropped four basis points to 3.57 percent. .

“The People’s Bank of China’s liquidity injections are showing its intention to protect the market at this sensitive period of time,” said Sun Binbin, a Shanghai-based analyst at Tianfeng Securities Co.