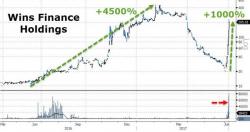

"We Really Don't Know What's Going On" - Nasdaq Halts China Loan Company After 1000% Spike

A few months ago, a tiny Chinese company (that trades on Nasdaq and is part of the Russell 2000) soared 4,500% and then crashed after Bloomberg reported on the 'surprisingly' strong debut. Well, it's happening again... Wins Finance Holdings has exploded 1000% in the last few days and nobody knows why.

No, this is not a Bitcoin-related entity... The company’s market value later tumbled by billions of dollars after Bloomberg reported in March on the mystery.