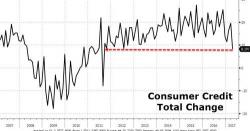

In the latest red flag for the US economy, moments ago the Fed reported that consumer credit for the month of April rose a paltry $8.2 billion, barely half the consensus estimate of $15.5 billion, and 40% of march's $19.5 billion. This was the lowest monthly increase in consumer credit going back nearly 6 years to August 2011. The increasingly obvious downward trendline in crediting is hardly indicative of a confident consumer.

While revolving, i.e. credit card, debt rose a modest $1.5 billion, far below the increase in the prior two months...