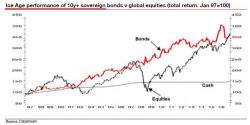

"Investors Should Be Petrified" Of The Coming Ice Age: Here Are Albert Edwards' Scariest Charts

Congratulations to Albert Edwards who this morning announced that he has once again placed first in the 2017 Extel Survey of analysts in the Global Strategy category, for the record 14th year in a row.