FANG Flop Sparks D(own)-Day For Stocks As Dollar Dumps To 8-Month Lows

73 years ago today...

Gold remains the big winner post-payrolls...

73 years ago today...

Gold remains the big winner post-payrolls...

Via Long Convexity blog,

As a trader one of the most frustrating things is to have the correct view on the direction of the market, while not being able to monetize that view because you have the wrong structure on.

Due to the lack of a deep & liquid options market in fed fund futures, many market participants - particularly macro players - instead leverage the highly liquid eurodollar options market to express views on the direction of short-term interest rates.

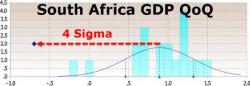

Despite expectations (among 19 'economists') that growth would be up 1.0% in Q1, South African GDP tumbled 0.7% (the second drop in a row) pushing the nation back into recession after eight years.

The median of 19 economists’ estimates in a Bloomberg survey was for 1 percent expansion. There was only one forecast for a contraction. This was a four standard deviation miss...

Indicating contraction for the second quarter in a row - technically signaling a recession - as all bar two industries shrank.

As we’ve been outlining for weeks now, Subprime 2.0 is the subprime auto-loan industry. And just as the collapse in the subprime mortgage lending was what signaled the beginning of the housing crisis… trouble in the subprime auto-loan industry will be what signals that the next Debt Crisis is here.

On that note… subprime auto-loan defaults are soaring, hitting 11.96%. The last time they were anywhere near these levels was in early 2008 right before the credit crisis hit.

Authored by Sumit Roy via ETF.com,

Bitcoin is flying. Prices for the digital currency briefly topped $2,800 in May, the latest milestone in what's become a parabolic move higher. Consider these figures: In the past month, bitcoin is up 68%; year-to-date, it's up 154%; over the past year, it's up 350%; and over the past two years, it's up 973%.