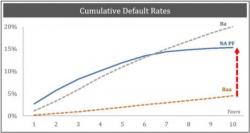

Central Banker's Real Legacy: Pension Funds Panic 'Reach' For Yield

Authored by Eugen von Bohm-Bawerk via Bawerk.net,

Authored by Eugen von Bohm-Bawerk via Bawerk.net,

The uber implosion at Uber continues.

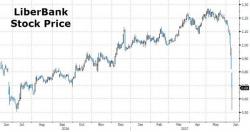

Authored by Don Quijones via WolfStreet.com,

Stockholders and junior bondholders fear another “bail-in.”

The start of another week is upon us, which means it is time for choice excerpts from the latest letter to clients by One River Asset Management CIO Eric Peters, who today writes about Brexit, the "new generals" in the market (more in a later post), rising populism in a world of tech "monopolies", modern day robber barons, and much more.

We will have more from today's letter shortly, but for now here is Peters on a topic on everyone's minds, volatility, and what Friday's Nasdaq "air pocket" means:

Beep Beep

This is an extract and summary from "New Gold Pool at the BIS Basle, Switzerland: Part 1" which was first published on the BullionStar.com website in mid-May.

Part 2 of the series titled "New Gold Pool at the BIS Basle: Part 2 – Pool vs Gold for Oil" is also posted now on the BullionStar.com website.