Stocks & Bonds Slip As US Macro Slumps To 16-Month Lows

So... we have another terror attack in London, the biggest geopolitical earthqwuake in the Middle East in years, US macro data is dreadful... and stocks don't budge...

So... we have another terror attack in London, the biggest geopolitical earthqwuake in the Middle East in years, US macro data is dreadful... and stocks don't budge...

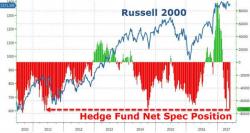

The Russell 2000 Index posted a 2.2% decline in May, its worst month since October, and it appears a large swath of investors is now betting it has further to fall.

As Bloomberg notes, hedge funds and other major speculators have a combined net short position of 73,030 contracts in the small-cap index’s futures, according to the latest data from the Commodity Futures Trading Commission.

Authored by Tsvetana Paraskova via OilPrice.com,

The market expectations for electric vehicle makers are significantly overestimated, Igor Sechin, CEO of Russia’s oil giant Rosneft said on Friday, adding that the evaluation of Tesla is based on “extremely aggressive” sales expectations.

Speaking at the St. Petersburg International Economic Forum, Sechin also criticized Tesla’s business model and capital spending.

While VIX closed at its lowest level since 1993 on Friday, VVIX (which tracks the anticipated volatitilty of VIX) completed a fourth week of gains in five, reaching a record high relative to the measure of equity turbulence.

As Bloomberg notes, with the VIX down more than 30% this year through the end of last week, investors have been using options to bet on volatility.

Having told its employees "don't panic" over the weekend (at the crashing stock and bond prices of Spain's 6th largest bank), it appears investors are ignoring that message as Banco Popular's credit curve has inverted for the first time since 2012 in the biggest red flag yet that Spain's banking crisis is systemic and about to test the EU's bail-in laws.

Banco Popular Chairman Emilio Saracho sent a letter to staff assuring them the bank remains solvent after Friday's stock crash, courtesy of Expansion, google translated: