Beijing Goes Global: China Expands Marine Force 400%; First Overseas Military Base Almost Complete

Authored by Daniel Lang via SHTFplan.com,

Authored by Daniel Lang via SHTFplan.com,

One day after yesterday's at times painfully uncomfortable first official meeting between Angela Merkel and Donald Trump, it will hardly come as a surprise that during today's G-20 meeting in Baden Baden, Germany- the first for the Trump administration, whose delegation is led by Treasury Secretary Steven Mnuchin - where the dominant topic is trade, and specifically globalization vs protectionism, that a row would break out over how the post-Trump world will deal with trade.

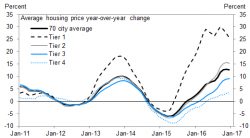

A couple of research reports released overnight by Deutsche Bank and Bank of America, respectively, come to a sobering conclusion: the fate of the global economy may be in the hands of the Chinese housing bubble. As a reminder, China is a serial bubble inflator courtesy of a closed (capital account) economy, and nearly $30 trillion in bank deposits which slosh from one asset class to another, be it the stock market, bitcoin, commodities, farm animals or - most often - housing.

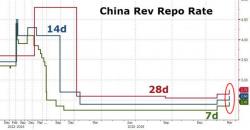

As we reported on Wednesday evening, something interesting took place on Thursday morning in Beijing: in a case of eerie coordination, China tightened monetary conditions across many of the PBOC's liquidity-providing conduits just 10 hours after the Fed raised its own interest rate by 0.25% for only the third time in a decade.

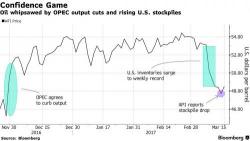

It is fitting that just a few hours until the Fed's second rate hike in two quarters, and one day after Goldman downgraded global stocks to Neutral for the next 3 months, not to mention with the results of the anticipated Dutch election due shortly, that global stocks as well as S&P futures are higher, while crude oil has finally managed to stage a rebound as the Dollar DXY index is fractionally in the red.