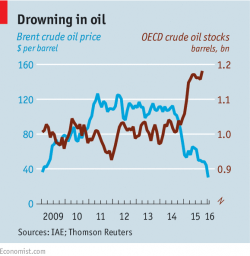

Crude Oil Slides Below $28, Lowest Since 2003, Dragging US Equity Futures Lower

Traders had some hope that they could take at least a brief nap ahead of the China open before all risk hell broke loose in the latest evening session, however either some liquidating algo or the Iranian oil trading desk had different plans, and moments ago WTI dipped below $28 per barrel, sliding as low as $27.92, doing so only for the first time since 2003, a new 12 year low.

The plunge in the highly correlated asset promptly dragged not only the USDJPY carry pair but also the E-Mini well lower, with ES sliding as low at 1861 moments ago before recouping some of the losses.