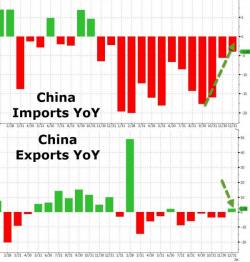

Global Stocks Rebound As Fears Of Chinese Hard-Landing Pushed Back On Strong Trade Data

After several of weeks of sharp currency devaluation, the market was carefully watching last night's China trade data to see if the Yuan debasement had led to a positive trade outcome to the world's second biggest economy, and as reported last night, it was not disappointed when China reported a December trade surplus of $60.09 billion from $54.1 billion in November, as a result of exports rising (2.3%), the first increase since June, while imports declined by just 4%, the lowest since 2014 despite China importing a record amount of oil, or 33.2 million tons, ostensibly to take advantage of