Bullion Pops & Trannies Drop As S&P Signals "Golden Cross"

And your post-Doha gains are... gone...

And your post-Doha gains are... gone...

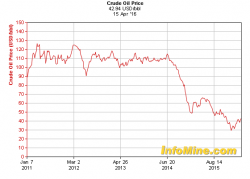

After meandering steadily higher for the past week, and completely ignoring the negative newsflow out of the Doha meeting, today oil took an unexpected leg lower to 4-day lows, leaving many stumped: what caused this drop?

The answer, according to Citi, is the realization Saudi Arabia is actually making good on its threat to boost production (recall that just one day ahead of Doha, Saudi deputy crown prince bin Salman said he could add a million barrels immediately) something we noted a month ago in "Why Saudi Arabia Has No Intention To End The Oil Glut."

Submitted by Rakesh Upadhyay via OilPrice.com,

Saudi Arabia single-handedly scuttled the Doha meeting, knowing all along that Iran would not participate, with a valid reason. The Russians and others agreed to proceed without Iran, planning to include them at a later date. So if everything was known beforehand, why did the Saudi’s pour cold water on the aspirations of the remaining members, risking its alienation from Russia and the OPEC community?

by David Haggith from The Great Recession Blog

As predicted relentlessly here, the scuttled meeting in Doha to limit oil production broke up with no agreement at all. The meeting foundered like a tanker snagged in the dessert sands because of the singular obvious factor that should have sunken all hope weeks ago but did not: Saudi Arabia said, “No deal without Iran.”

Doha disaster predictable yet not the disaster that was predicted

Submitted by Brandon Smith via Alt-Market.com,

Most people are not avid followers of economic news, and I don’t blame them. Financial analysis is for the most part boring and tedious and you would have to be some kind of crazy to commit a large slice of your life to it.