Stocks Scramble To 4th Longest Stretch Of 'Dip-less' Gains In 90 Years

Relax, we got this...

Relax, we got this...

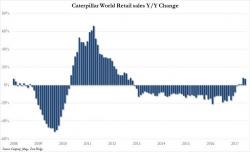

As is customary for the heavy-industrial equipment manufacturer, Caterpillar yesterday reported its retail sales, one day ahead of earnings, and as we discussed, the number was solid with Caterpillar reporting the longest positive streak in retail sales going back 51 months.

Authored by Mohamed El-Erian via Bloomberg.com,

Over the past few months, government bond yields have fallen, the dollar has weakened and financials have underperformed, yet the major stock indexes are at or very near record highs, as persistently supportive liquidity conditions have more than compensated for policy and growth disappointments.

By boosting returns and repressing volatility, ample liquidity is a gift for investors. It makes the investment journey pleasing, comfortable and lengthy. But it is not a destination.

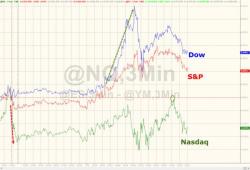

The euro's surge to an almost two-year high put a cap on the global market rally in Friday's quiet session, with most major exchanges consolidating after a second strong week of gains. The MSCI Asia-Pacific index declined for first time in ten days while the European Stoxx 600 index was fractionally in the green as were US equity futures ahead of earnings reports from General Electric, Honeywell, Schlumberger and others. Oil gained with Brent flirting with $50, zinc rallied along with most base metals.

The relentless risk levitation continued overnight, as global shares extended their stretch of consecutive record highs on Thursday for a 10th day after a cautious BOJ lifted Asian stocks to a decade high with a dovish announcement that offered no surprises, while pushing back Kuroda's 2% inflation target to 2020, the 6th consecutive delay. With all eyes on the ECB in just over an hour, US equity futures are in the green, following solid gains around the globe. European stocks extended their biggest gain in a week while Asian equities maintained their rally.