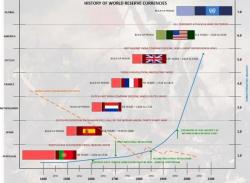

De-Dollarization Spikes - Venezuela Stops Accepting Dollars For Oil Payments

Did the doomsday clock on the petrodollar (and implicitly US hegemony) just tick one more minute closer to midnight?

Source: The Burning Platform

Apparently confirming what President Maduro had warned following the recent US sanctions, The Wall Street Journal reports that Venezuela has officially stopped accepting US Dollars as payment for its crude oil exports.