FX Week Ahead: Myopic Markets Hit USD On Inflation Miss

Submitted by Shant Movsesian and Rajan Dhall MSTA from fxdaily.co.uk

FX Week Ahead - Myopic markets hit USD on inflation 'miss' - rest of the major economies in focus ahead.

Submitted by Shant Movsesian and Rajan Dhall MSTA from fxdaily.co.uk

FX Week Ahead - Myopic markets hit USD on inflation 'miss' - rest of the major economies in focus ahead.

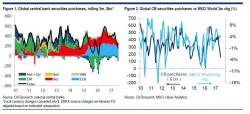

For all the recent concerns about an "imminent" nuclear war with North Korea (not happening, according to the head of the CIA), which prompted a stunned reaction from Morgan Stanley which earlier today observed the "70% rise in the VIX index over three days, 2% drop in global equities, and more than a few holidays disrupted", leading it to conclude "Well, That Escalated Quickly", the market continues to ignore the real risk: the upcoming central bank balance sheet taper which will have a dire and drastic impact on markets according to Citi's global head of credit product strategy, Matt King

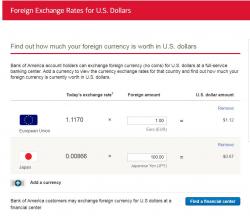

We all know that the majority of people don’t know FX (Foreign Exchange) so this topic should come as no surprise. (For those who haven't already, checkout Splitting Pennies for a quick guide on this topic) However, it’s important for traders and investors to understand how the US banks are ripping off their clients, and the only reason they do it is because clients allow them, because they don’t understand how they’re being scammed. What we are talking about is the retail deliverable foreign exchange market.

The Actual Terrorists

This is an article written by an Austrian, Klaus Madersbacher, who, somehow, was able to see through the heavy blanket of Amerian propaganda that suffocates the ability to think and to pereive throughout the entirety of Europe. He correctly undersands the Western destruction of Libya as a war crime. Germans were executed by the Nuremberg Tribunal for less.

Blame The Russians, The Chinese, The North Koreans, and The Welsh... but not The Fed...

Overnight saw more China turmoil.. (MSCI China ETF saw its biggest drop since Brexit)