France: Churches Vanish, Mosques Spring Up

Authored by Giulio Meotti via The Gatestone Institute,

Authored by Giulio Meotti via The Gatestone Institute,

Authored by Pepe Escobar via InformationClearingHouse.info,

The Empire of Whiners simply can't get enough when it comes to huff, puff and pout as the Empire of Sanctions.

With an Orwellian 99% majority that would delight the Kim dynasty in North Korea, the "representative democracy" Capitol Hill has bulldozed its latest House/Senate sanctions package, aimed mostly at Russia, but also targeting Iran and North Korea.

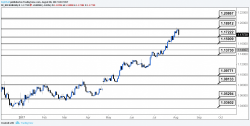

Submitted by Rajan Dhall from fxdaily.co.uk

With the dollar index now 10 points below its recent cycle highs from early January, nervous dollar bulls are starting to reevaluate their initial assumption that this would be a short-term pullback, and many are worried that this could be the start of a new secular bear market.

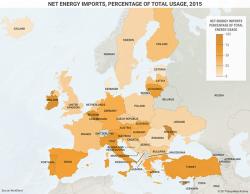

Authored by George Friedman, Xander Snyder, and Ekaterina Zolotova via MauldinEconomics.com,

The US Congress has passed new sanctions targeting Russia’s energy companies. Among the other notable aspects of the sanctions is that they take some authority away from the US president (who used to be able to implement some measures but not others at his discretion) and give it to Congress.