Hedge Fund Traders Return To Banking As Trump Promises To 'Make Prop Trading Great Again'

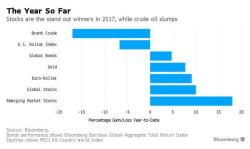

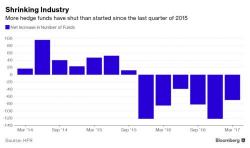

The hedge fund industry is finding itself in increasingly dire straits as persistently weak returns and the advent of low-cost investing have forced more and more funds to shut down. So, it's unsurprising that, amid this steadily worsening backdrop, more traders are heading for the exits. But where are the heading? Increasingly, more traders are moving back from where they came - i.e. the big banks, which expect to see a boost in trading revenue as President Donald Trump has vowed to dial back postcrisis regulations that forced banks to wind down their prop desks.