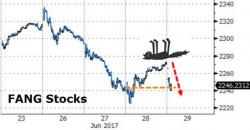

One Bank Reveals The "Three Big New Themes In Markets"

A lot changed over the past 4 days, starting with Draghi's unexpectedly hawkish speech earlier this week (subsequent ECB clarification notwithstanding), followed by a barrage of hawkish Fed speakers - including Yellen - all of whom warned that risk assets are overvalued, then the heads of the BOE and BOC, who also came out surprisingly hawkish and warned rates hikes are coming, and finally the conclusion of the ECB's forum in Sintra, where the hawkishness was palpable. In short: coordinated global central bank tightening, or at least jawboning.