Dollar Dumped, Tech Stocks Pumped As Central Banker Bias Turns Tighter

More crappy data and every central banker in the world turning hawkish... BTFD you idiots!!

As we noted earlier... there's only one thing standing...

More crappy data and every central banker in the world turning hawkish... BTFD you idiots!!

As we noted earlier... there's only one thing standing...

By Bill Blain of Mint Partners, Blain’s Morning Porridge – June 28th 2017

Uncertainty, confusion, a Tech-sell off.. but are things as bad as they seem?

“Now I got mortgages and homes, I got stiffness in my bones, ain’t no beauty queens in this locality…”

As we reach towards month end and the half-year, markets do not feel like they are in particularly solid territory. Lots of uncertainty out there. Relax. Never as bad as you think, but it helps to understand what is really going on. Noise, and lots of it.

U.S. index futures point to a slightly higher open, as markets in both Europe and Asian fall.The EUR surges to one year highs as markets continue to reverberate from Draghi's hawkish comments while yields rose around the globe following similar hawkish comments from Fed speakers on Tuesday.

If you look at a modern map of the world’s most populous cities, you’ll notice that they are quite evenly distributed around the globe.

Metropolises like Moscow, New York, Tokyo, Cairo, or Rio de Janeiro are spread apart with very different geographic and cultural settings, and practically every continent today can claim at least one of the world’s 20 most populous cities.

Authored by Kevin Muir via The Macro Tourist,

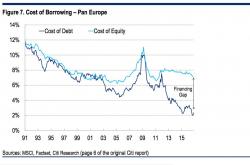

Like a bad parent who doesn’t love his kids equally, I have a confession. My infatuation with European stocks has stopped me from seeing clearly. For the past year I have buying European stocks. When I started, the idea was certainly out of favour - Pretty sure I am alone in this trade. Over time, it gathered momentum, and I stuck with it - The Best Trade on the Board.