ISIS: Losing The Battle, But Winning The War

Authored by Giulio Metti via The Gatestone Institute,

Authored by Giulio Metti via The Gatestone Institute,

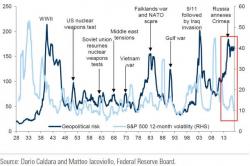

As we have pointed out numerous times, Goldman notes that elevated US policy uncertainty and geopolitical risk indicate heightened risk of more frequent political and geopolitical tail events, in the form of both ‘known unknowns’ or ‘unknown unknowns’...

And given the extreme complacency in markets, Goldman suggests the following trade as a clean way to play that concept of reality emerging into market pricing once again...

Which equity option strategies work in low volatility markets?

One of the reasons for the recent historic flattening in yield curves is not just the ongoing disappointment in inflation prints which have missed expectations for the past three months, but also the ECB's recent sharp downward revision to its inflation forecasts, which as it revealed in its latest policy meeting, were cut across the board, with HICP now expected to drop from 1.6% to 1.3% in 2018, sending Bund yields tumbling.

That the sharp drop took place even with the ECB's balance sheet rising to record highs of €4.232 trillion as of the latest week...

In an eventful overnight session which saw a historic transition in Saudi Arabia, an unexpected Republican victory in the Georgia Special Election, China's inclusion in the MSCI EM index and Travis Kalanick's resignation, S&P futures continued to fall, alongside stock markets in Asia and Europe, while oil prices extended their drop despite a larger than expected draw reported by API on Tuesday.