"Q1 Earnings Were Great, But..." - Goldman Pours Cold Water On The Strongest Quarter Since 2011

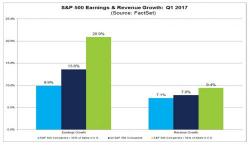

With 91% of companies in the S&P500 having reported earnings for the first quarter, Q1 2017 earnings season is almost fully in the history books, and is shaping up as the best quarter for annual earnings growth in six years. According to FactSet, the blended earnings growth rate for the S&P 500 in the first quarter is 13.6%, up from 13.5% last week, while revenue is poised to grow 7.8% Y/Y. The rise in profits was a function of both solid sales growth (+7.8%) and a 41 bp expansion in margins to 9.4%.