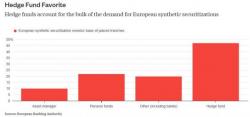

Meet The New, "Safe" Synthetic CDO's That Could Spell Disaster For The European Banking System

So what do you do if you're a European banking regulator faced with the task of maintaining a safe, sustainable financial system amid a concerning growth in bank leverage. Well, if you said sell down risk assets then you're just being silly or completely ignoring your implicit obligation to engineer higher banking profitability at all costs.