A Loser's Malice: What's Behind Obama's Attacks On Putin

Submitted by Michael Jabara Carley via Strategic-Culture.org,

Submitted by Michael Jabara Carley via Strategic-Culture.org,

Submitted by Giulio Meotti via The Gatestone Institute,

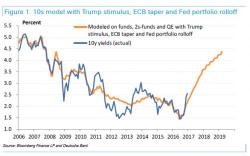

With Trump's border tax adjustment looking increasingly likely, the stock market - as JPM has warned in recent days - is starting to fade the relentless Trumponomic, hope-driven rally since election day instead focusing on the details inside the president-elect's proposed plans. And, as explained earlier in the week, if the border tax proposal is implemented, economists at Deutsche Bank estimate the tax could send inflation far above the Federal Reserve's 2% target and drive a 15% surge in the dollar.

I'd like to be able to say France withdrawing from the EU is a potential downside catalyst for stocks. However, these days nothing matters. Stocks would go up if nuclear war was initiated wordwide. There's literally nothing that can stop stocks from heading higher.

But in the event you're still nostalgic about news, France's Le Pen wants stronger ties with Moscow, out of the EU and NATO -- in an effort to make France great again.

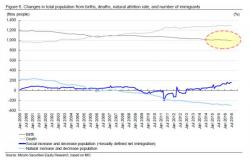

While both global monetary and fiscal policies struggle to keep aggregate demand if not rising, then at least constant, demographics continues to wreak havoc on the best laid plans of central planners around the rapidly aging world. Just last week we reported that in 2016, the US population grew at the slowest pace since the Great Depression, largely driven by the collapse in household formation as the number of Millennials living at home with their parents has hit a 75 year high.