Futures Unchanged In Thin Pre-Holiday Tape; Italian Bank Bailout Lifts European Shares

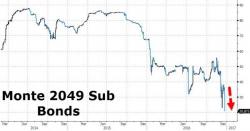

European stocks halted two days of declines, with the Stoxx 600 fractionally in the green and Italy’s bonds climbing after Monte Paschi requested a bailout and Italy pledged to provide support for its other ailing lenders. S&P futures were little changed among extremely thin volumes while Chinese stocks dropped amid concerns on higher borrowing costs. Oil slid, while gold advanced; bitcoin soared to multi-year highs, rising above $900.