Why Negative Rates Are Positive For Gold

Submitted by John Browne via Euro Pacific Capital,

Submitted by John Browne via Euro Pacific Capital,

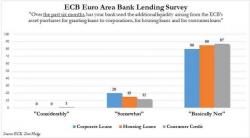

As the WSJ wryly put it this morning, "Officials at the European Central Bank surely celebrated Tuesday's survey showing the last barrage of asset purchases and negative rates had a positive effect on bank lending to households and businesses."

Alas, as the WSJ also adds, "policy makers may want to hold off uncorking the champagne just yet. In fact, most banks answering the survey said the ECB's policies had no impact at all."

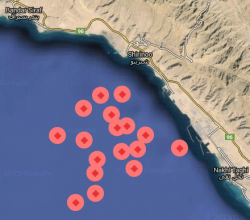

Late last week, just ahead of the Doha meeting, we showed that Iran's existing oil tanker armada which until recently had been on anchor next to the Iranian coast and which according to Windward data was storing as much as 50 million barrels offshore...

... had finally started to move.

NIRP has proven to be a dud as far as monetary policy goes.

Europe has implemented FOUR NIRP cuts since June 2014. Throughout this period, EU inflation has barely flat-lined.

The story is similar for Japan, which implemented NIRP at the end of February 2016. Since then the Yen has surged.

While Japanese inflation is trending down: