Frontrunning: April 20

- After big New York wins, Trump and Clinton cast themselves as inevitable (Reuters)

- Eastern States Take Turn in Presidential Primary Spotlight (WSJ)

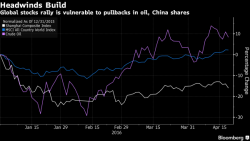

- China's Stocks Tumble Most in Seven Weeks to Break Trading Calm (BBG)

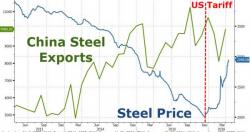

- Oil falls on end to Kuwaiti strike, supply outlook (Reuters)

- Oil price's decline weighs on global stock markets (Reuters)

- Blankfein's Decade Ending With a Thud on a Humbled Wall Street (BBG)

- Toyota to Resume Production at Most Japan Plants Next Week (WSJ)