The Silver Age Of The Central Banker (Ends Badly)

Submitted by Ben Hunt via Salient Partner's Epsilon Theory blog,

Submitted by Ben Hunt via Salient Partner's Epsilon Theory blog,

Authored by John Coumarianos, originally posted at MarketWatch.com,

One view of what caused the Great Depression in the 1930s is that the Federal Reserve failed to prevent a collapse in the money supply.

This is the famous thesis of Milton Friedman’s and Anna Schwartz’s A Monetary History of the United States, 1867-1960, and it was, more or less, the view of Ben Bernanke when he was chairman of the Federal Reserve.

The global economy today resembles that of the 1930s in several ominous ways.

On Friday, David Cameron trumpeted a “deal” the British PM says he secured with the EU that will reduce the UK’s financial burden as it relates to refugees and other EU nations.

To be sure, the “agreement” seems more symbolic than anything. Indeed, it’s not even clear exactly what it is Cameron accomplished with negotiations in Brussels. Apparently, the UK won concessions on welfare curbs and financial regulation, and the ambiguity surrounding the agreement didn’t stop the PM from proclaiming he had secured “special status” for Britain in the EU.

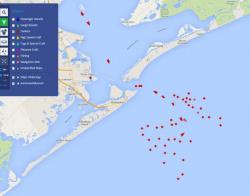

While we have previously observed the massive glut of oil product in the US, which has led to such arcane developments as a "parking lot" of oil tankers outside of Galveston, TX...

... or ships loaded to the brim with crude making U-turns in the middle of the Atlantic Ocean, taking advantage of the supercontango while unable to find buyers...

Authored by Stephen Roach, originally posted at Project Syndicate,