The Monetary Policy "Berlin Wall" Is Coming Down

Submitted by Adam Taggart via PeakProsperity.com,

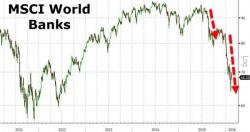

As we've been watching closely, something is wrong with the big banks. Their shares have lost 25-33% of their market value since the beginning of the year. What's going on?

The turmoil seems greatest in Europe, where bank shares have fallen the hardest, and negative interest rates have appeared with increasingly frequency across member countries.