More Bad News For European Banks? ECB Leaks "Firm Support For A Deposit Rate Cut"

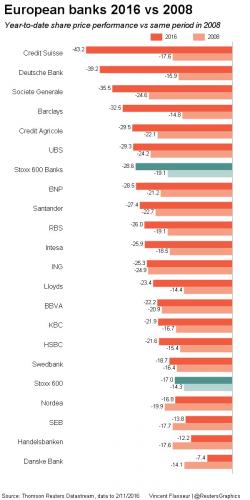

After starting out strongly this morning, with DB stock trading just shy of $17/share, European banks have seen some weakness in the past hour following a report from Reuters, in which sources were cited as saying that there is "firm support for a deposit rate cut within the European Central Bank's Governing Council." While a year ago this would have sent European stocks soaring, this is no longer the case as explained by none other than Deutsche Bank last weekend: