European Bank Bloodbath Crashes Bond, Stock Markets

Just as we warned, not only is it time to panic but the panic is 'contagion'-ing over into the sovereign risk market. European banks are in freefall, down over 4.3% broadly, crashing to 2012's "whatever it takes" lows.

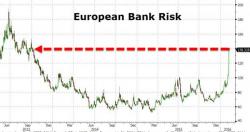

European bank risk has gone vertical... Today's spike is the largest since April 2010

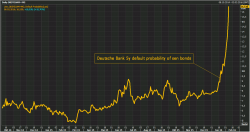

TBTF banks are all seeing credit risk explode - to 52-week highs and beyond...

Slamming European bank stocks back to near "whatever it takes" lows...