Europe Rebounds From Chinese Rout After Stellar PMIs; US Closed For Holiday

Nothing can keep the BTFD spirit at bay in Europe this Thanksgiving morning.

Nothing can keep the BTFD spirit at bay in Europe this Thanksgiving morning.

Authored by Kevin Muir via The Macro Tourist blog,

All credit for the first part of today’s post goes to LongConvexity, the mysterious Ari-Gold-type hedge fund manager, who reminded me of the enormous seasonal effect in the US 5/30 year treasury yield curve spread.

For the past eight years, the US yield curve has been flattening like a banshee, with the 5/30 spread declining from 300 basis points, all the way to the current 102 bps.

Authored by Kevin Muir via The Macro Tourist blog,

Remember last November when it seemed like everyone was a US dollar bull?

Either they thought Trump would usher in the next Reaganesque US economic free market nirvana, or they were convinced there was this massive US dollar emerging markets short position from the years of USD debt issuance.

Nothing better illustrates the one sided nature of US dollar sentiment than the early December 2016 issue of The Economist.

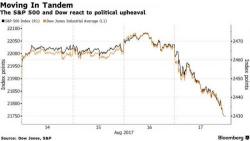

The global risk-off mood accelerated overnight on Trump "stability concerns", coupled with fallout from the Spain terrorist attack and lingering North Korea tensions, even if the VIX is off its latest highs, trading just above 15. Investors fled into German and U.S. Treasury bonds and bought gold for the third day in a row, as the appeal of such top-notch assets grew further due to a deadly attack that killed at least 13 people in Barcelona.

Authored by Kevin Muir via The Macro Tourist blog,

The Eurostoxx outperformance of the past month has garnered a lot of attention, but there is another similar trade many investors are missing. Not only that, but it has a positive carry, something that is sorely lacking in this day and age of NIRP.

Since early April, the German Bund / US T-note 10 year yield spread has rallied 35 basis points, rising from negative 220 bps to 185 bps.